Some Known Questions About Paul B Insurance.

Wiki Article

Some Known Facts About Paul B Insurance.

When it concerns a life insurance coverage plan, numerous plans permit an insurance holder can obtain their whole family members covered. Mostly all the insurance provider provide the simple of insurance coverage costs calculator. An individual can determine the lumpsum premium he will have to pay instead of the insurance policy cover. It makes it less complicated for the consumers to choose their bargain.

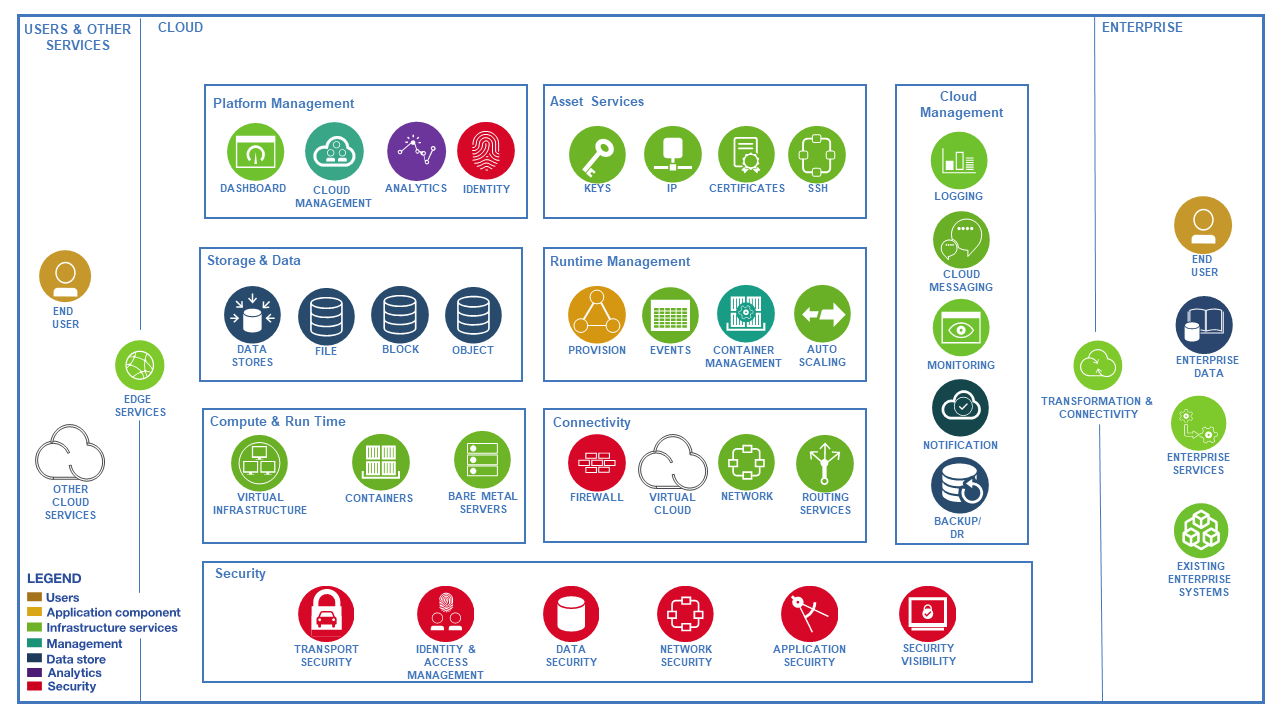

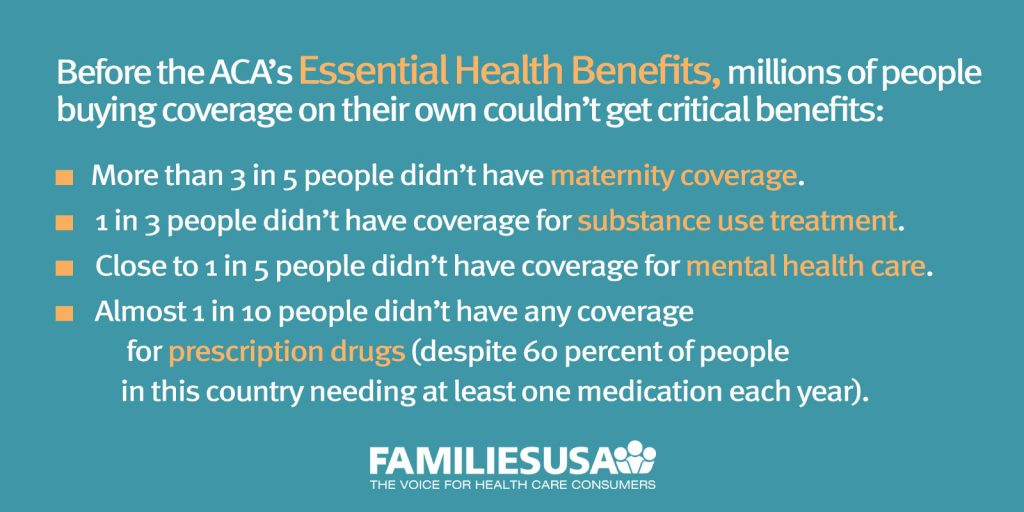

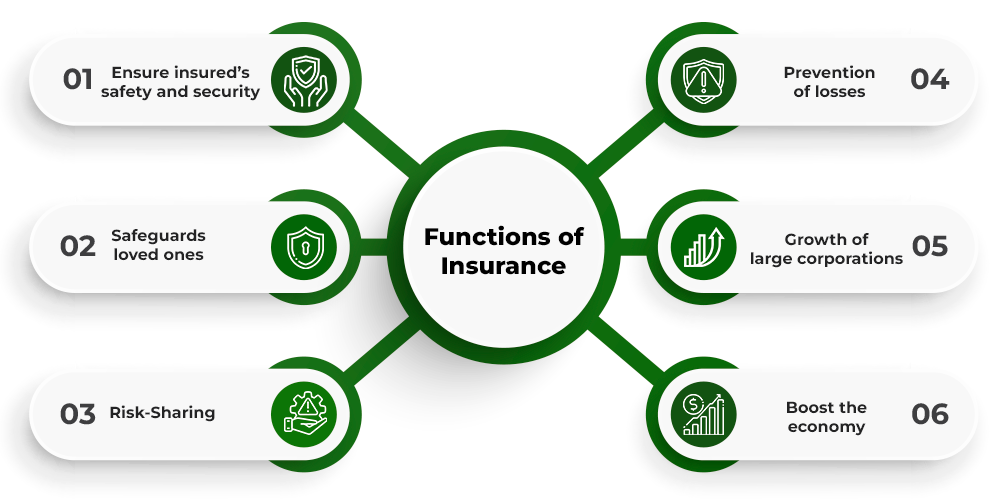

General insurance policy products been available in numerous kinds covering a wide variety of risks such as medical insurance, electric motor insurance coverage, aquatic insurance policy, obligation insurance, traveling insurance and also commercial insurance etc. Insurance is a reliable risk administration device that safeguards what is precious for us life, health and wellness, residence as well as services and so on. The requirement of insurance coverage might vary from one person to an additional, but there are specific types of insurance policy products that are essential for every individual for guaranteeing a secure future.

Complying with insurance coverage products are the essential for any type of private today. As nobody intends to leave their enjoyed ones monetarily smashed, life protection is just one of the must-have for every private having dependents. In instance of life insurance, the sum guaranteed or the protection quantity will certainly be paid out to the nominee of the guaranteed in the event of the fatality of the insured.

The Only Guide for Paul B Insurance

Electric motor insurance policies are the mandatory lawful requirement in India for every single car proprietor under the Automobile Act. Be it two-wheeler, vehicle or a business vehicle, its compulsory to get 3rd party obligation motor insurance to secure oneself versus the insurance claims that might occur from one more party throughout a mishap.

The priority of any type of insurance coverage item may vary depending on your private requirement. Insurance coverage is a huge sector with countless product kinds available to provide to every sort of need.

Critical ailment insurance coverage plan might not be needed for each person, particularly, if you do not have any family members background of essential ailment. Crucial illnesses are occasionally covered in medical insurance plans and additionally comes as a rider together with life insurance policy plans. A standalone cover for critical disease depends purely on the demand of an individual.

Top Guidelines Of Paul B Insurance

Sometimes travel covers also come as your credit report card traveling advantage. Similarly, there are lots of insurance coverage kinds that are not suitable or required for every single individual (Paul B Insurance). It is necessary to consider the advantages that you can gain prior to buying an insurance policy strategy. Prior to you acquire any insurance coverage, it is very important to understand the need for insurance.

Objective of cover Dangers that you wish to be covered against Just how lengthy you may require the protection Price When trying to discover what insurance policy is, it is necessary to understand its various elements (Paul B Insurance). Now that you have actually experienced the insurance policy meaning, take a look at some of its elements also: When it comes to life insurance coverage meaning, coverage is an essential part.

The costs depends upon the chosen amount ensured, the regularity of superior settlement, and also the plan's period. A great function of a life insurance coverage policy is that the costs remains continuous throughout the term of the plan. It is, as a result, commonly recommended that life insurance policy ought to be acquired as early in life as possible.

Related Site

Some Known Questions About Paul B Insurance.

Insured obtains the tax obligation advantages for costs paid relying on the insurance policy item kind. As an example, the costs paid in the direction of life insurance policy intends gets approved for tax deduction under Area 80C of the Earnings Tax Obligation Act. And, the premium paid towards medical insurance prepares certifies for tax obligation reduction under Section 80D of the Earnings Tax Act.

Fortunately, Ram has taken a term insurance policy cover of INR. His better half got payment from the insurance company within 10 days which assisted her pay off the debt and invest the corpus for future demands.

Sunil, a staff member in a multinational company in Mumbai all of a sudden fell subconscious due to high fever. He was after that rushed to the nearest hospital. He was confessed for 3 days in the medical facility for medical diagnosis as well as therapy. When he was discharged after 3 days, his health center bill came near around INR.

The Facts About Paul B Insurance Uncovered

websitesFortunately, he had actually taken a wellness insurance policy coverage for INR. If he had not recognized the importance of insurance coverage, he would certainly have to pay INR.70, 000 out of his pocket.

When the insurance claim amount is less than the deductibles, the insurance policy holder is not accountable to obtain any claim amount. The apparent guideline of deductibles is, you obtain the insurance claim quantity if only the claim amount exceeds the deductible quantity. As an insurance holder, you do not require to pay the deductibles to the firm.

If the case is increased for INR 40,000 then the Copay incurred by the policyholder will certainly be INR 4,000 et cetera of the INRV 35,000 will certainly be sustained by the insurance coverage business. While insurance deductible is the set amount that the insurance policy holder needs to surpass in order to elevate an insurance coverage case.

The Basic Principles Of Paul B Insurance

Deductibles are an one-time restriction. When the insurance holder crosses the insurance deductible limit, he/ she does require not to pay any kind of various other quantity till the next plan year.

useful linkInsurance is an extremely unique market. The whole value of an insurance coverage of any kind of kind stays within an easy assurance: The pledge to pay a potentially huge advantage in the occasion of a case. However the case might take place lots of, years in the future. As an example, life insurance policies consistently pay no advantage for numerous years throughout which time the policy proprietor is paying costs.

The general document of the insurance policy sector is excellent no legit life insurance case, to name one line, has actually ever gone overdue in the United States simply since an insurance business ended up being insolvent. Yet the reality is that all insurance coverage claims as well as all annuity benefits are subject to the claims-paying capability of the insurance provider.

Paul B Insurance Can Be Fun For Everyone

There is much less danger in insuring with strong business than with insurance providers with much less stable funding frameworks. Furthermore, some errors as well as noninclusions policies may not offer defense to insurance policy representatives in situations arising from lower-rated insurance policy firms state, rated B+ or even worse. There is no bank assurance readily available on insurance products of any kind, nor is there any kind of government insurance policy readily available to back insurance provider that obtain right into problem.

Best, Fitch or Standard and also Poor's, the lower your threat. Alan Wang, Alan Wang is the President of UBF and serves as the lead consultant.

Talk to an agent: An insurance agent can aid you assess your risks and recommend coverage options tailored to your business size. When finding the ideal organization insurance policy, there are a few key factors to take into consideration. Selecting the most thorough insurance coverage for your business is vital, as it can secure your company from losses.

Report this wiki page